A thorough Texas title loan risk assessment involves understanding state regulations, borrower creditworthiness, and financial health. Key factors include loan amount limits, interest rates, term considerations, and repayment plans. Assessing borrowers' income, employment history, existing debt, and vehicle collateral value ensures responsible lending while mitigating delinquencies and prioritizing customer satisfaction.

Conducting a thorough Texas title loan risk assessment is paramount for lenders to mitigate potential losses. This guide outlines a strategic approach, focusing on understanding local regulations, evaluating borrower financial standing, and assessing collateral value. By delving into these key areas—from the legal framework to the borrower’s creditworthiness and the security of the collateral—lenders can make informed decisions, ensuring responsible lending practices in Texas. Learn how to effectively assess risk and minimize exposure.

- Understand Texas Title Loan Regulations and Requirements

- Evaluate Borrower's Financial Health and Creditworthiness

- Assess Collateral Value and Risk of Default

Understand Texas Title Loan Regulations and Requirements

Conducting a thorough Texas title loan risk assessment is paramount to ensure compliance with state regulations and mitigate potential financial risks. Before offering any loan products, lenders must familiarize themselves with the specific laws governing Texas title loans. These regulations outline the parameters for loan amounts, interest rates, term limits, and payment plans, among other criteria. Understanding these requirements is essential for fair lending practices and preventing legal complications.

Lenders should also consider the creditworthiness of borrowers by evaluating their income, employment history, and existing debt obligations. A comprehensive risk assessment includes analyzing the borrower’s ability to repay the loan on time, thereby minimizing delinquencies and defaults. By adhering to these guidelines and conducting a detailed risk analysis, lenders can navigate the Texas title loan market effectively while prioritizing both customer satisfaction and financial security.

Evaluate Borrower's Financial Health and Creditworthiness

Evaluating a borrower’s financial health is a critical step in conducting a Texas title loan risk assessment. It involves scrutinizing their income, employment status, and overall credit history. Borrowers seeking a Texas title loan should be able to demonstrate a stable source of income and a good credit score, as these are strong indicators of their ability to repay the loan. A thorough review of their financial situation ensures that the loan is a suitable financial solution for them.

This process includes analyzing their Loan Terms and understanding their ability to meet the repayment obligations. Many lenders offer online applications, making it convenient for borrowers to initiate the application process from the comfort of their homes. However, it’s crucial not to solely rely on these applications; additional documentation and verification may be required to assess the borrower’s true creditworthiness.

Assess Collateral Value and Risk of Default

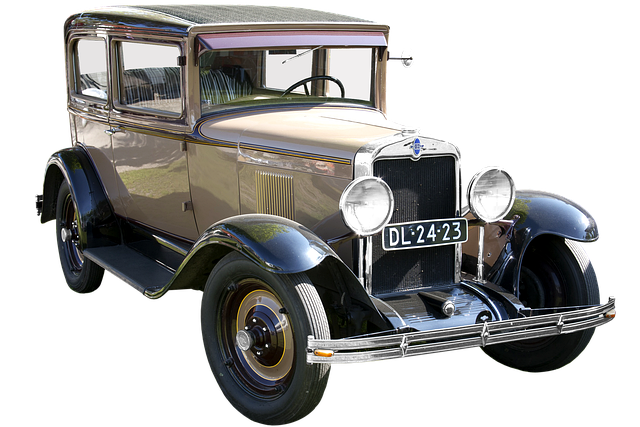

When conducting a Texas title loan risk assessment, one of the primary factors to consider is the collateral’s value and the potential for default. The collateral in this context is the vehicle owned by the borrower, which serves as security for the loan. It’s crucial to thoroughly evaluate the condition, age, and current market value of the vehicle to determine its true worth. This process involves examining the car’s make, model, year, mileage, and any existing damage or needed repairs. The goal is to ensure that the collateral is substantial enough to cover the loan amount in case of default.

Additionally, assessing the borrower’s risk of default requires an analysis of their financial situation. Reviewing their income, employment history, and credit score provides insights into their ability to repay the loan. In San Antonio Loans, where fast cash is often a priority, it’s essential to strike a balance between providing access to funds and mitigating the risk of non-repayment. This includes considering factors like stable employment, regular income streams, and a good credit history, which can lower the risk assessment and make borrowers more eligible for loans through Online Application processes.

Conducting a comprehensive Texas title loan risk assessment involves understanding state regulations, evaluating borrower financial health, and assessing collateral value. By adhering to these steps, lenders can make informed decisions, ensuring both compliance and minimizing default risks associated with Texas title loans. Incorporating these practices into your lending process is key to fostering a robust and responsible loan ecosystem in the Texas market.